Introduction

Wouldn't it be great if you could manage your expenses the same way you did with your piggy bank as a kid? You could have absolute control and decide consciously where you wish to spend. And all you had to do was keep track of your pennies and recall the last time you indulged in cotton candy. Unfortunately, things were a little too difficult for the pink porcelain piggy to handle as you grew older.

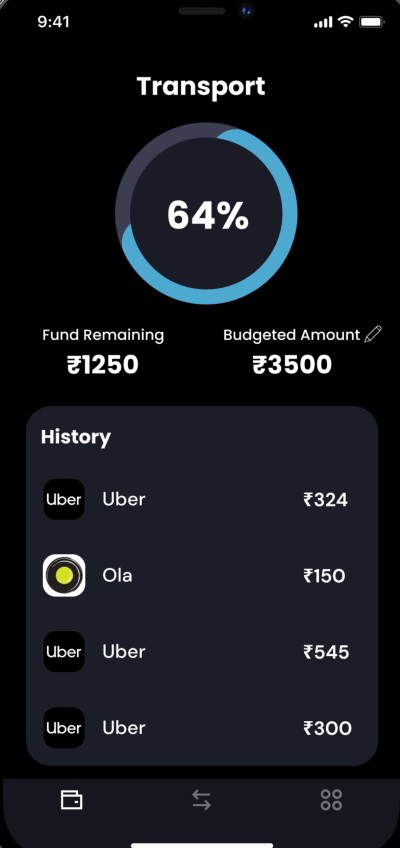

Today there is no mechanism to reconcile payments with the increasing number of payments apps that are available to use. Consumers have no method of knowing their spending habits and trends across apps and categories in order to make conscious spending decisions and save better. Consumers in India have insufficient control over their money. And thus, Zero Balance is solving all of them in one app.

Founded by Yaagni and Parth, Zero Balance brings a worry-free payments solution for consumers. Using Zerobalance’s virtual card, consumers can take control of their payments. Users can now decide who can charge their card, how much, and how often.

Yaagni and Parth were classmates in undergrad college and both of them were always keen on solving real-world problems. They were constantly discussing the problems of day-to-day life and throwing off ideas with one another. Zero Balance started off in an attempt to solve the doubt and underconfidence consumers have while providing their card details for in-app purchases in gaming and other apps. With the help of Zero Balance Virtual Cards, the real bank account details always stay secure and allow users to make confident and worry-free spending. They soon realised that the solution could also be beneficial to GenZs and millennials in helping them stay on top of their spending.

Zero Balance is named after the Zero-based budgeting method. It’s a hyper-effective methodology that allocates funds based on the efficiency and necessity of programs rather than on budget history. Hence naming every penny you spend.

Market Opportunity

The market opportunity for Zero Balance is the 250 Million GenZs and Young Millennials in urban cities of India who collectively spend 10 Billion dollars monthly. They require added controls and deep insights into their money to help them spend and save confidently.

100X.VC Thesis

Individuals who will use Zero Balance cards for all their payments will be able to spend in a worry-free manner. They will eliminate unconscious overspending, track every penny, and save confidently. They will also never have to reveal their real bank account information again, keeping everything safe and secure. It's a fantastic opportunity. The Zero Balance team is well-balanced, experienced in fintech, and understands the problem at its core because they have experienced it first hand. This is a new segment, according to 100X, and the total space has a lot of potential in the developing Indian consumption market.

Conclusion

With the team and the product, Zero Balance can prove to be an excellent platform for individuals to enable controls, set budgets, manage savings and analyse their expenses. We wish the team all the very best!