Introduction:

More than 136 countries comprising more than 90% of the world’s GDP have pledged to go carbon neutral including India which is aiming to reduce its carbon intensity by 45% by 2030 from its 2005 levels. Climate change is a pressing issue that is seeing renewed cooperation from all stakeholders including startups, policymakers, corporations and consumers across the globe. ESG framework’s rise to fame in 2000s was led by a report titled “Who Cares Wins: Connecting Financial Markets to a Changing World” by United Nations Environment Programme (UNEP FI) and backed by 20 of the most reputed financial institutions, endorsing the need to integrate Environmental, Social and Governance factors into making financial investments by institutions.

Today the corporations around the globe are mandated by regulations to track and report their ESG progress. In India, Business Responsibility and Sustainability Reporting (BRSR) introduced by SEBI makes it mandatory for the top 1000 largest companies by market value to disclose their ESG metrics. Regulations in EU like the stringent ESG disclosure compliance needs and the proposed EU carbon tax makes it the need of the hour for Indian MSMEs exporters to track and report their ESG disclosures. ESG compliances are complex and need a company to collect, monitor, analyse and report data on a host of sub factors within the ESG framework. The frameworks and the metrics being tracked are multidimensional and incurs serious cost and time commitment by the firms with low coherent visibility and strategic insights. Companies today are undertaking this to stay compliant and competitive globally.

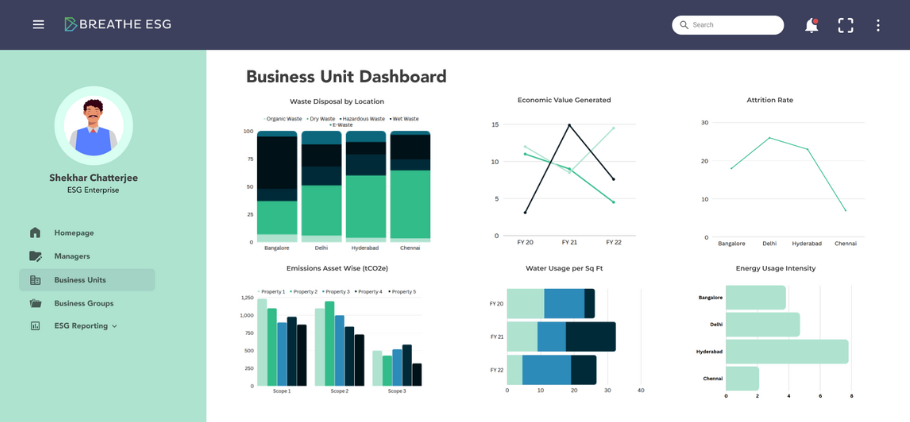

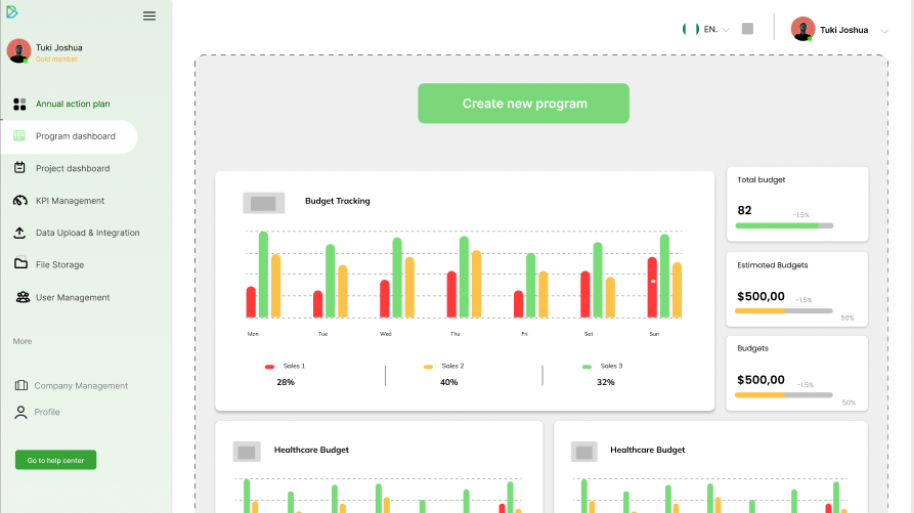

Breathe ESG is a comprehensive SaaS platform for the sustainability management needs of enterprises, philanthropies and nonprofits. The platform offers services for ESG and CSR integrations, analytics and reporting. The comprehensive nature of the platform along with its easy to use experience and in-built reporting tools reduces the complexity of collecting, tracking and analysing data from diversified source points (across operations, partners and value chains) and therefore reduces cost and time commitment needed to comply with different global standards of ESG reporting.

Existing players in the market are solving for tracking and reporting in only a particular niche like that of Carbon accounting and management or CSR management softwares. A streamlined platform works in the best interest of corporations by reducing complexity and the hassle of managing and analysing multiple data points and factors across platforms. Therefore a comprehensive platform would provide unified insights and transparency to all industry stakeholders which will come handy in making informed strategy choices towards greener or offset initiatives. BreatheESG is uniquely positioned by controlling the entire ESG reporting and sustainability transformation journeys for corporates, creating high trust client relationships with serious potential to score big on retention, LTV of clients and securing advisory gigs from clients. This can create meaningful defensibility for the platform and create high switching cost for corporate clients once they are deeply rooted in the transformation journey loop of the platform.

The founders of BreatheESG radiate dynamic energy towards solving for sustainability. Karantaj Singh, Co-Founder at BreatheESG has deep expertise in ESG and Impact projects having worked as an Associate Consultant - ESG with KPMG India and co-founding a non-profit organisation called Deepam Initiatives which works towards creating a sustainable impact in lives of those living in rural India. Shaayak Chatterjee, Co Founder at Breathe ESG has experience in strategy and sustainability having worked as a management consultant with Illumine, as well as a project consultant who helped set up the climate finance and renewable energy verticals of the India Climate Collaborative. He also co-founded the Alliance for Sustainable Finance. Saurav Fouzdar, CTO of Breathe ESG is a startup veteran and has built the tech teams of SaaS Labs, Send33 and spoofsense.ai which have gone on to raise over $70m from investors like Sequoia US.

Market Opportunity:

The target group for BreatheESG consists of companies looking to achieve their sustainable goals by making ESG disclosures and management of CSR contributions, Private Philanthropy and nonprofits who are looking to streamline their operations and management of partners. The Serviceable Obtainable Market stands at $1.2 billion, taking the assumption that 150k organisations in India and Asia with more than 50 employees that can report on ESG, CSR or Social Impact.

100X.VC Thesis:

ESG is becoming more relevant and important globally. Multinationals and Private equity are deeply focusing on it and hence BreatheESG timing is perfect. There are only a few handful SaaS platform offerings for the same globally and BreatheESG has an advantage to become the one stop for everything on ESG management for large corporations.

Conclusion:

ESG frameworks have gained momentum post the signing of Paris Climate Agreement. Major economies around the world are adopting aggressive policy shifts such as net zero pledges, setting up of Emissions Trading Scheme and increased sustainability and CSR compliances. These structural evolutions form the basis for our core conviction on ESG as a sustained theme going forward. We strongly believe in the dynamic team at BreatheESG to continue to build and innovate the corporate sector’s transition to a green economy.